Mauritius vs Seychelles: Where Should You Register Your Forex Business?

To prosper in the FX industry, it is essential that you choose the right region for your business, as it affects operational efficiency, tax liabilities, and regulatory compliance.

The Seychelles and Mauritius are well-liked locations for getting a Forex licence. For FX brokers, both jurisdictions are appealing since they provide distinct advantages. Understanding the distinctions between Seychelles vs Mauritius is vital to make a smart decision.

The banking environment, the regulatory framework, the tax consequences, and the operational benefits are all important factors to consider when selecting a jurisdiction. Assessing these elements assists in choosing the ideal region for your forex company.

Key Takeaways

- Seychelles and Mauritius provide different legal systems. The FSC regulates Mauritius, while the FSA sets regulations for Seychelles.

- The banking system in Mauritius is strong and offers a wide range of PSP choices. Though it does offer IBAN and SWIFT services, Seychelles has fewer PSPs.

- For FX enterprises that are not residents, Mauritius offers a tax rate of 0%. The corporate tax rate in Seychelles is 1.5%, with several tax benefits.

- The licensing procedure is more drawn out and intricate in Mauritius. Seychelles provides an expedited and streamlined application process.

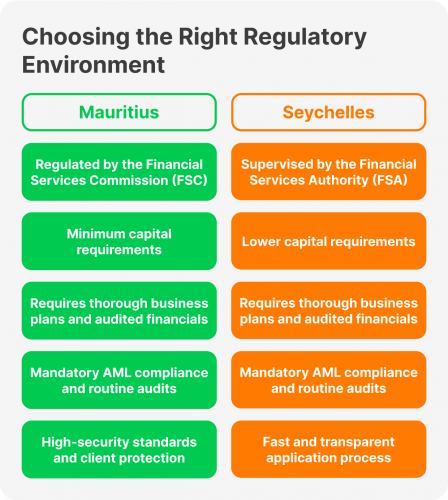

Regulatory Environment

It’s crucial to select the appropriate jurisdiction when registering your FX firm. The regulatory systems of Mauritius and Seychelles make them appealing choices for forex broker licenses. You may choose wisely if you are aware of the benefits and requirements of each.

Mauritius

The Financial Services Commission (FSC) oversees Mauritius’ regulatory environment. This framework ensures market integrity and compliance by providing Mauritius forex brokers with clear criteria.

To receive a Mauritius forex license, brokers need to fulfil certain requirements:

- The FSC has set a minimum capital requirement for brokers. You may visit here to determine the mauritius forex license cost.

- The licensing process requires submitting thorough business plans, audited financial documents, and evidence of funds.

- Brokers are required to carry out routine audits and abide by anti-money laundering (AML) laws.

The regulation of Mauritius has various benefits. Implementing strict security procedures guarantees high-security standards for financial operations. The regulatory framework in Mauritius gives brokers the essential freedom to adjust to shifting market conditions. The FSC also strongly emphasises strict client protection guidelines to guarantee that consumers are properly protected.

Seychelles

On the other hand, the Seychelles regulatory framework is supervised by the Financial Services Authority (FSA). This structure offers an easy-to-follow method for getting and keeping a Forex license.

FX brokers should follow the following rules to apply for a Forex license in Seychelles:

- Requires less starting capital than other jurisdictions. You can check Seychelles Forex license cost by clicking this link.

- The licensing process is a simplified procedure that requires the submission of necessary documentation and evidence of money.

- Compliance with AML guidelines and consistent FSA reporting.

The Seychelles has a more streamlined application process, making obtaining Forex licenses faster. Because of the reduced capital requirements, it is easier for startups and smaller forex companies to enter the market. Also, the FSA offers precise regulatory requirements that guarantee equity and transparency.

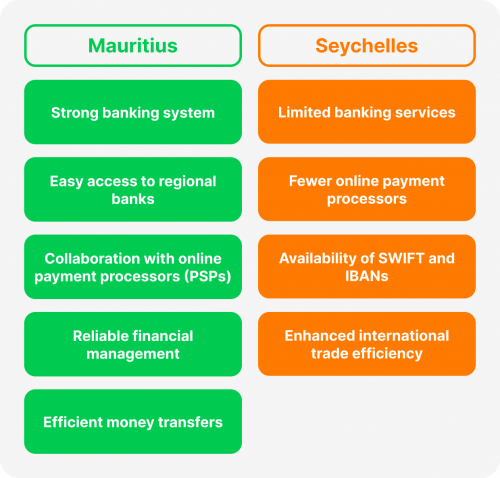

Banking and Financial Infrastructure

Forex brokers in Mauritius enjoy the advantages of a strong banking system and easy access to regional banks. Most of these institutions are willing to collaborate with FX brokers to facilitate easy financial transactions. The operational capabilities of forex brokers in Mauritius are further enhanced by the presence of online payment processors (PSPs).

Reliable financial management and effective money transfers are two critical services a well-established banking industry offers that are vital for FX enterprises.

Seychelles, on the other hand, offers an alternative situation. While banking services are available to forex brokers in the Seychelles, their selection is more constrained than in Mauritius.

Brokers licensed in Seychelles have access to fewer PSPs, which may affect how simple it is to handle payments. However, Seychelles provides certain operational benefits, such as the availability of SWIFT and International Bank Account Numbers (IBANs), which speed up international trade and improve the effectiveness of forex trading operations.

Taxation and Financial Benefits

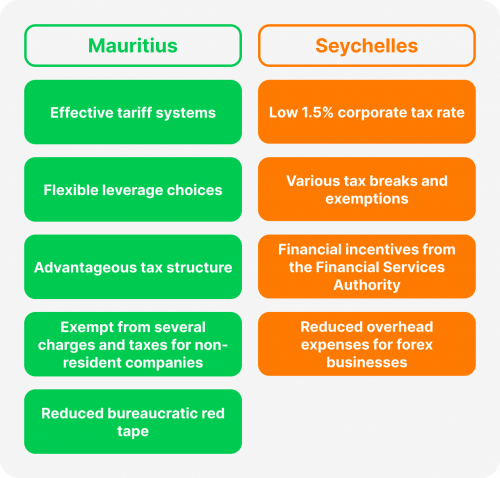

Mauritius and Seychelles each provide unique tax and financial incentives for forex brokers. Mauritius offers effective tariff systems, flexible leverage choices, and an advantageous tax structure. On the other hand, Seychelles provides extra financial incentives that reduce operating expenses and a low corporate tax rate.

Mauritius

- International Business companies not residents of Mauritius are excluded from several charges and taxes, which can drastically lower operating expenses for forex brokers. The region’s forex industry is encouraged to establish itself by this advantageous tax structure.

- Mauritius provides a business-supporting effective tariff system. The structure’s goal is to increase the operational efficiency of forex brokers by reducing bureaucratic red tape and streamlining the tax compliance process.

- Forex traders benefit from Mauritius’s regulatory system, which permits flexibility in leverage. Foreign exchange transactions are not subject to regulatory limitations, giving brokers more latitude in controlling their trading operations.

Seychelles

- The 1.5% corporation tax rate in Seychelles is advantageous for forex brokers who want to reduce their tax obligations. This low tax rate can considerably lessen the financial load on businesses involved in the currency market.

- Seychelles forex brokers are eligible for some tax breaks. The Seychelles is a desirable offshore destination for forex businesses due to its favourable corporate tax rate and exemptions from various local taxes.

- Forex brokers may be eligible for financial incentives from the Seychelles Financial Services Authority. Among them are the reduced overhead expenses of managing a broking business in this offshore region. These incentives can increase the profitability of forex trading operations and lead to a more favourable business model.

For instance, A forex brokerage is considering expanding its operations to Mauritius and Seychelles. Let’s break down the case of Mauritius:

1. Corporate Tax:

- For businesses that are not Mauritius residents, the tax rate is 0%.

- For instance, the company won’t have to pay corporation income tax on its forex trading gains if it forms a non-resident company in Mauritius.

2. Financial Services Tax:

- 1.5% of financial services gross revenue is subject to taxation.

- For example, the firm would be required to pay $15,000 in financial services tax if its forex trading in Mauritius brought in $1 million in gross revenue.

3. Stamp Duty:

- Tax Rate changes according to the kind of transaction.

- In Mauritius, stamp duty on share transfers typically equals 0.1% of the transaction amount.

4. Other Taxes:

- 15% value-added tax (VAT) is applied to goods and services.

- Withholding Tax is charged on some types of income.

Now, let’s take a look at what happens in Seychelles.

1. Corporate Tax:

- 1.5% of worldwide income is subject to tax.

- For instance, the firm would owe $15,000 in corporate tax in the Seychelles if it made $1 million in profits worldwide.

2. Tax on Financial Services:

- There is no tax rate.

- For example, in the Seychelles, the company would not be liable to any financial services tax.

3. Stamp Duty:

- Depending on the type of transaction, the tax rate varies.

- For instance, in Seychelles, stamp duty on share transfers is typically equal to 0.1% of the transaction amount.

4. Other Taxes:

- There is no value-added tax (VAT).

- Withholding Tax applies to some types of income.

Fast Fact

With 24.0% of daily forex transactions, the most traded pair is EUR/USD.

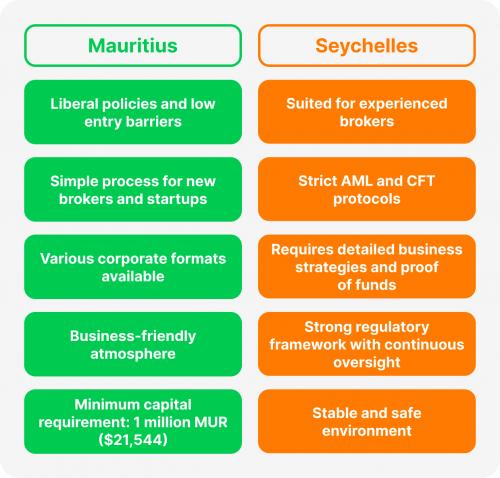

Operational Considerations

Mauritius’s liberal policies and low entry barriers make it an attractive destination for emerging FX companies. To abide by local regulations, brokers must maintain appropriate account segregation and meet minimum capital requirements. This jurisdiction supports the formation of brokerage companies and streamlines the process for new entrants into the industry.

Foreign enterprises can simply establish a presence in Mauritius through various corporate formats, including a company limited by shares or a worldwide business license. Because of how simple the process is, smaller brokers and startups find it appealing.

The FSC has regulations that brokers must follow. These include keeping client funds appropriately segregated, following AML and CFT standards, and having a minimum capital of one million Mauritius Rupees ($21,544).

Mauritius is known for its business-friendly atmosphere and effective bureaucracy. As a result, brokers may find it simpler to acquire the required licenses, permissions, and approvals.

Because of its stricter license requirements, Seychelles is better suited for experienced brokers. Businesses must create thorough anti-money laundering (AML) and counter-financing of terrorism (CFT) protocols and register locally. Firms wishing to migrate or grow their worldwide business operations are better suited to this jurisdiction.

Brokers who want to apply for a Seychelles license must show they have more financial and professional resources. Detailed business strategies, audited financial documents, and proof of adequate money may be required.

Seychelles has a strong regulatory framework, which includes continuous oversight of licensed businesses and stringent AML/CFT regulations. Brokers may benefit from a more stable and safe environment, but compliance demands more work upfront.

For seasoned brokers aiming to grow their business or attract a more affluent clientele, Seychelles is a great fit. The more severe regulatory framework can improve brokers’ legitimacy and standing in this region.

To sum it up, Mauritius is Perfect for new forex businesses looking for a comparatively simple entry point and a welcoming regulatory framework. While Seychelles is a better option for experienced brokers seeking a more transparent and strict regulatory environment.

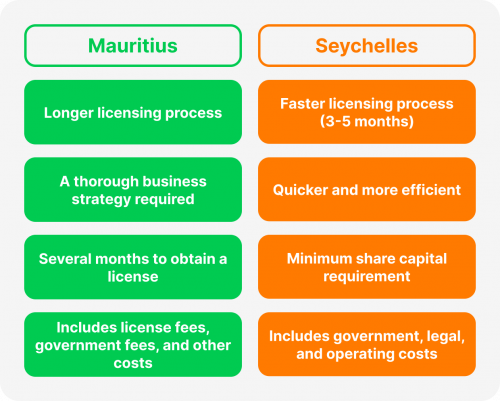

Timeframe and Cost

In Mauritius, obtaining a licence as a forex broker usually takes longer. The costs include license fees, government fees, and other related costs. Brokers who want to begin forex trading operations in this jurisdiction must budget for these expenses and time commitments.

In Mauritius, obtaining a forex license can be quite a drawn-out procedure. A thorough business strategy must be created, the application has to go to the FSC, it must pass regulatory review, and finally, a license must be obtained. Although the duration may differ, it usually takes many months.

A license includes fees from the government, legal and regulatory changes, and operating costs. These expenses may differ based on the particular needs and application complexity.

The Seychelles license procedure generally moves more quickly, requiring three to five months. Costs include the minimum share capital requirement and supplementary expenses for setup and compliance. Brokers looking for a seamless introduction into the forex market can profit from this quicker and frequently more affordable approach.

Getting a forex licence in Seychelles is usually quicker and more efficient. It entails incorporating in the Seychelles, submitting an application for a forex licence, passing regulatory review, and getting the license. Three to five months will be enough time to finish this process.

The Seychelles minimum share capital requirement, government, legal and regulatory fees, and operating costs are all expenses related to getting a license. These expenses may differ based on the particular needs and application complexity.

Which Option is Better?

Think about things like capital gains tax, banking infrastructure, regulatory climate, and operational benefits when choosing where to register your forex firm. While Mauritius and the Seychelles have unique advantages, knowing how they differ is essential to making an informed choice.

The legal systems of Mauritius and Seychelles are advantageous to forex brokers. The FSC of Mauritius oversees the implementation of specific regulations related to market integrity and compliance. The FSA-regulated nation of Seychelles provides a simplified application and renewal procedure for FX licenses.

Essential things to think about:

- Seychelles is a good option for experienced brokers looking for a more respectable setting because of its strict regulations.

- Entry barriers are lower, and the licensing process is more straightforward in Mauritius, making it a more appealing option for companies.

- Regulatory solid structures are in place in both nations to guarantee compliance and protect investors.

- Financial solid facilities are available in Mauritius, and online PSPs and local banks are easily accessible.

- Seychelles offers SWIFT and IBAN services for effective international transactions. However, its range of banks and PSPs is somewhat constrained.

- For forex brokers, both Mauritius and Seychelles provide advantageous tax incentives. For non-resident enterprises, Mauritius offers a flexible leveraging system and a corporate tax rate of 0%. Seychelles provides several tax exemptions together with a low corporation tax rate of 1.5%.

- Seychelles charges 1.5% corporate tax, while Mauritius provides a 0% rate for non-resident enterprises.

- For FX enterprises, Seychelles provides a range of tax breaks.

- For forex trading, Mauritius offers a more adaptable leverage structure.

Conclusion

In summary, there are differences between the regulations and benefits of launching an FX business in Mauritius and Seychelles.

Brokers ought to determine which jurisdictions best suit their operational requirements and unique business objectives. Consider elements like tax advantages, licensing fees, and regulatory needs. For long-term success, the jurisdiction has to complement your business plan.

To make an informed choice, consult a specialist. In-depth knowledge of the Financial Services Authority Act, regulatory compliance, and operational ramifications can be obtained from experts, ensuring that you choose the jurisdiction that best fits your forex trading activity.

FAQs

Is it Legal to Trade FX in the Seychelles?

If one has the necessary license, it is allowed, yes. Businesses are required to submit reports to the FSA and follow regulations, such as KYC and AML procedures.

Is There a Regulation for FX Trading in Mauritius?

A FSC license is needed to trade forex in Mauritius. Every trading license is supervised and approved by the FSC.

Is Registration Necessary for FX Traders?

Any Brokerage should obtain a license. Depending on the chosen nation, there may be differences in the requirements for getting a licence.